The Bigger-Waters Flood Insurance Reform Act is a significant piece of legislation that seeks to address the challenges related to flood insurance in the United States. The Biggert-Waters Act was signed into law in 2012 and significantly changed the National Flood Insurance Program (NFIP). Understanding the critical provisions of this reform act is crucial for homeowners, insurance providers, and policymakers alike.

Overview of the Bigger-Waters Flood Insurance Reform Act

The Bigger-Waters Flood Insurance Reform Act was enacted in response to the financial strain on the NFIP resulting from the increasing frequency and severity of flood-related disasters. The act aims to make the program financially stable, improve accuracy in flood risk assessment, and create a more sustainable flood insurance market.

One of the primary objectives of the reform act is to eliminate subsidies for Florida flood insurance policies gradually. Before this act, some policyholders benefited from artificially low premiums, leading to an imbalance in the system’s finances. The reform phases out these subsidies over time, ensuring that premiums align more closely with the actual risk of flooding. Additionally, the act encourages private insurers to provide flood insurance coverage, promoting competition and expanding options for policyholders.

Fundamental Changes and Implications of the Reform Act

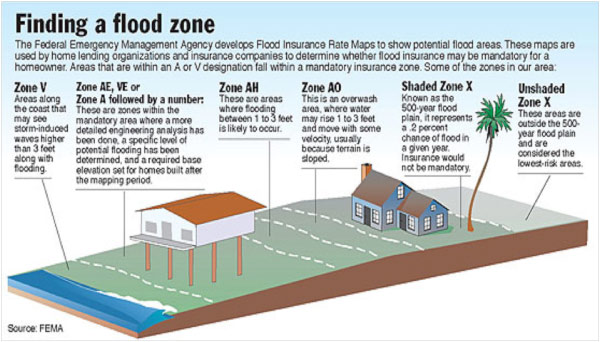

The fundamental changes brought about by the Bigger-Waters Flood Insurance Reform Act have significant implications for Florida homeowners insurance policyholders. One notable difference is updating flood risk maps. Carriers use them to determine insurance rates. The act requires the Federal Emergency Management Agency (FEMA) to revise and modernize these maps to reflect current flood risk accurately. This update ensures that policyholders pay premiums that accurately reflect their risk levels.

Another significant change is the implementation of annual premium rate increases for policyholders. Under the reform act, flood insurance premiums increase until they reach full-risk rates. This transition to full-risk rates ensures that the program can cover the costs associated with flood damage. Moreover, it promotes financial stability within the NFIP.

Conclusion

The Bigger-Waters Flood Insurance Reform Act represents a significant step towards a more sustainable and financially stable flood insurance program in the United States. First, it gradually eliminates subsidies and implements annual premium rate increases. Then, the act ensures policyholders pay rates commensurate with their flood risk. The more accurate flood risk maps and increased involvement of private insurers also contribute to a more competitive and comprehensive flood insurance market. Understanding the provisions and implications of this reform act is crucial for all stakeholders involved in flood insurance to navigate the changes and make informed decisions.

Comments are closed.