Car insurance in Florida has unique rules and requirements, leaving many drivers wondering how best to protect themselves and their families. Among the optional coverages available is Medical Payments, often abbreviated as “MedPay.” But with mandatory Personal Injury Protection (PIP) already in place, is adding Medical Payments coverage to your Florida auto policy worth the extra cost? Understanding the role and benefits of this additional coverage can help you make an informed choice on Florida car insurance to protect your financial security and well-being after an accident.

Understanding Medical Payments Coverage in Florida Car Insurance

Medical Payments coverage, or MedPay, is an optional add-on to your Florida car insurance policy that helps pay for medical expenses resulting from a car accident, regardless of who is at fault. In Florida, MedPay can cover you, your passengers, and, in some cases, members of your household. Carriers designed this coverage to supplement other medical and auto insurance coverage, providing an extra buffer for unexpected medical costs.

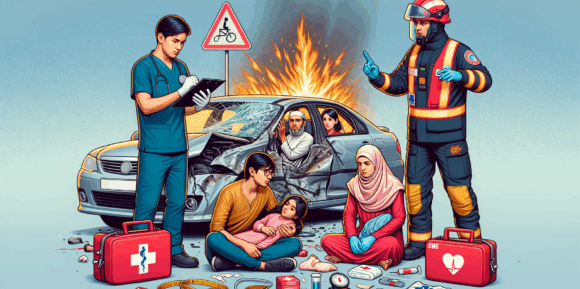

Unlike liability or property coverage, Medical Payments focuses explicitly on the immediate injury costs, such as ambulance fees, hospital visits, surgeries, and even funeral expenses. It pays out quickly, often without requiring proof of who was at fault in the accident, which can be crucial for timely medical treatment. This simplicity makes MedPay attractive to those who want fast access to funds after a crash.

In Florida’s no-fault system, MedPay is not mandatory, often leading drivers to overlook its value. However, it can be a critical asset, especially when medical bills exceed what your primary policy covers, or if you have high deductibles in your health insurance. Understanding how MedPay works within Florida law is essential before deciding whether to include it in your policy.

The Basics of Florida Auto Insurance Requirements

Florida […]