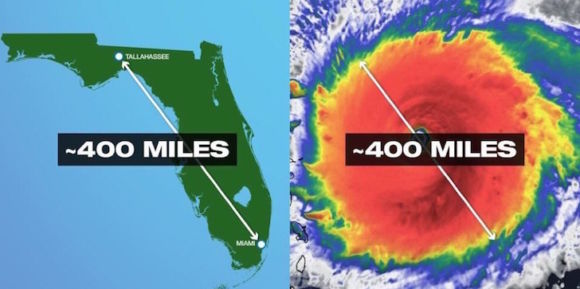

With Florida’s unique climate challenges, including hurricanes, flooding, and intense storms, understanding homeowner insurance options is crucial for residents. Carriers design homeowner insurance policies to protect property owners from unexpected perils, but not all policies offer the same coverage or flexibility. The most common types to compare are HO1, HO2, HO3, and HO5, each with distinct features and coverage scopes. This article provides a detailed comparison to guide Florida homeowners in selecting the most suitable insurance plan.

Overview of Homeowner Insurance Policies in Florida

Homeowner insurance in Florida is a vital financial tool that provides peace of mind in the face of weather-related risks and unforeseen incidents. Given the state’s exposure to natural disasters, lenders often require adequate coverage before approving a mortgage. Florida’s insurance market is unique due to high claims frequency and strict regulations, shaping the options available to consumers.

Policies are standardized nationwide to a degree, but insurers often tailor coverages to local risks and legal requirements in Florida. As a result, policyholders must be aware of both general types and Florida-specific offerings. The four most prevalent policy forms are HO1 (Basic Form), HO2 (Broad Form), HO3 (Special Form), and HO5 (Comprehensive Form). Each offers a different balance of coverage, exclusions, and cost.

Understanding the distinctions between these policy types is essential for making an informed choice. While HO1 and HO2 provide limited coverage, HO3 and HO5 offer more robust protection, which can be especially important in Florida’s high-risk environment. Yet, these enhanced coverages often come with higher premiums and stricter underwriting guidelines.

Some insurers in Florida have reduced or eliminated certain policy forms due to increased risks and costs in recent years. Nonetheless, a clear understanding […]