Florida’s auto insurance industry is known for its unique features and benefits that set it apart from other states. With various coverage options and affordable rates, Florida’s auto insurance offers drivers the peace of mind they need on the road. This article will examine how automobile insurance in Florida is different and what makes it an attractive choice for motorists.

Florida’s Auto Insurance: Unique Features and Benefits

Personal Injury Protection (PIP) Coverage

One of the distinctive features of Florida’s auto insurance is the Personal Injury Protection (PIP) coverage. This coverage is mandatory for all drivers in the Sunshine State. It provides medical expenses and income loss benefits regardless of fault in an accident. Unlike other states, where who is at fault is used to determine who pays for medical bills and other expenses, Florida’s PIP coverage ensures that you have access to immediate medical care and income replacement, regardless of who was at fault. This feature mainly benefits individuals without health insurance or limited coverage, as it provides significant financial support when needed.

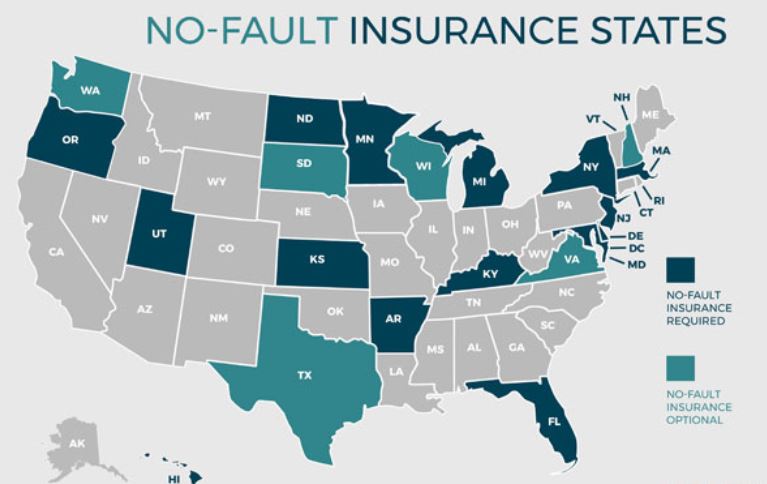

No-Fault Insurance System

Florida follows a no-fault insurance system, which means that each driver seeks reimbursement for their damages after an accident, regardless of who caused it. Under this system, drivers must carry a minimum of $10,000 in PIP coverage and $10,000 in Property Damage Liability (PDL) coverage. Florida’s no-fault insurance aims to streamline the claims process. Moreover, it reduces the burden on courts by allowing drivers to access benefits without lengthy legal battles. This unique aspect of Florida’s auto insurance ensures that you can receive compensation promptly. It will enable you to get back on the road and to your everyday life as soon as possible.

Competitive Rates and Coverage Options

Florida’s auto insurance market is highly competitive, offering drivers various coverage options at competitive rates. With numerous insurance providers vying for customers’ business, motorists can choose the coverage that best suits their needs and budget. Whether you prioritize comprehensive coverage, higher liability limits, or cost-effective minimum coverage, Florida’s auto insurance industry offers something for everyone. Additionally, the intense competition among insurance companies means that rates are often more affordable than in other states with fewer options.

Why Automobile Insurance in Florida is Different

Florida’s auto insurance goes beyond the standard coverage offered by other states. The unique features and benefits, such as Personal Injury Protection coverage, the no-fault insurance system, and the competitive rates and coverage options, make it stand out from the rest. These factors provide drivers with the peace of mind and financial security they need while on the road. By choosing Florida’s auto insurance, you can ensure you have protected yourself and prepared for unforeseen circumstances while driving in the Sunshine State.

Of course, these policies and limits are simply the minimum standards Florida requires to operate a vehicle on Florida’s roads. Drivers can purchase many other forms of Florida automobile insurance that cover other potential losses with higher coverage levels. You can also tinker with the amount of your deductibles to lower your yearly payments. Florida drivers often opt for collision coverage to pay for damage to their automobile in the event of an accident. In addition, they have comprehensive coverage to cover damage to your vehicle other than from an accident. Examples include vandalism or broken glass, towing, and associated labor if your auto breaks down. Finally, you need coverage if you are in an accident with an underinsured or uninsured motorist.

Even though Florida is a no-fault state, another party may be sued after an automobile accident. As a result, many Florida drivers opt for Bodily Injury Liability, or BIL coverage, in addition to their other automobile insurance. Suppose you’re found responsible for an accident. In that case, BIL will pay for injuries to accident victims up to your coverage limits. In addition, it will often pay for your lawyer’s fees if they sue you.

Conclusion

In conclusion, automobile insurance in Florida is different due to its unique features and benefits. With the Personal Injury Protection coverage, no-fault insurance system, and wide range of coverage options, drivers can access essential financial support and choose the coverage that best suits their needs. Moreover, the competitive rates offered by Florida Insurance Quotes ensure that drivers can obtain affordable coverage without compromising quality. When you opt for Florida’s auto insurance, motorists can confidently drive and have peace of mind. They will know they have protected themselves in any situation.

Comments are closed.