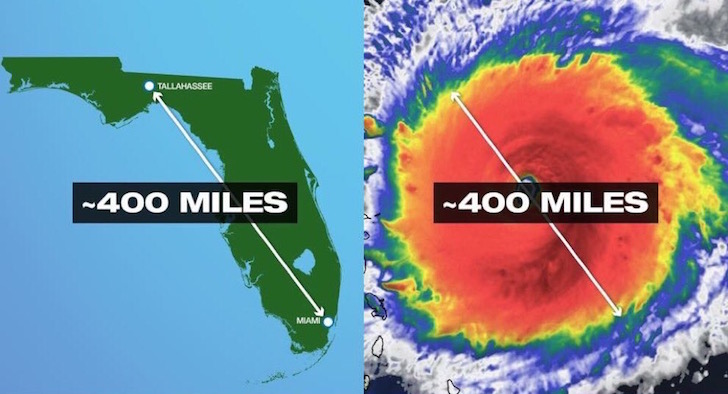

If you own a house in Florida, you know how important it is to protect it from potential risks. Various threats can damage or destroy your valuable investment, from hurricanes and floods to theft and fire. That’s why having a comprehensive insurance policy that covers all the potential risks is crucial. Florida Insurance Quotes offers the perfect solution to secure your Florida house with a free quote that guarantees your peace of mind. House owners in Florida know there is much work to secure finances on the house, in addition to taking care of the legalities of settling into that house with […]

Why Quotes Reduce your Florida House Insurance Rates in 2023?