Comparing HO1, HO2, HO3, and HO5 Policies in Florida

Comparing HO1, HO2, HO3, and HO5 Policies in Florida

Comparing HO1, HO2, HO3, and HO5 Policies in Florida

Insurance coverage is essential when protecting your home and property in a hurricane. However, finding accurate and reliable hurricane insurance quotes can be daunting. With the unpredictable nature of storms, it is crucial to understand the potential risks and costs involved comprehensively. This uncertainty is where Florida Insurance Quotes offers a trustworthy platform to obtain accurate Florida hurricane insurance quotes. What is Florida Hurricane Insurance? Has anyone heard the phrase hurricane insurance in Florida? We all have. While this is a commonly used term, it does not exist. However, combining policies can protect a home from hurricanes and their damages. For example, […]

Owning a home in Florida comes with its fair share of risks. They include hurricanes, tropical storms, wildfires, and flooding. With these potential threats in mind, owners in the Sunshine State must invest in comprehensive home insurance coverage. However, navigating the world of Florida home insurance quotes online can be overwhelming, especially for those unfamiliar with the industry’s intricacies. This guide will explore understanding and comparing Florida home insurance quotes. In addition, it will equip Floridians with the knowledge they need to make informed decisions about protecting their most valuable asset. Insurance is a need for anyone who buys a home. […]

Understanding condo insurance in Florida is crucial for any current or prospective condo owner in the Sunshine State. Ensuring adequate coverage can be complex, with unique weather risks and specific state laws and regulations. This article will guide you through the essentials of condo insurance, highlighting the primary requirements, types of coverage, and potential pitfalls. Whether you’re a first-time condo buyer or looking to update your existing policy, this comprehensive guide will help you confidently navigate the intricacies of condo insurance in Florida. Overview of Florida Condo Insurance Basics Condo insurance, often called HO6 insurance, is designed to protect the […]

Miami, FL, is known for its sunny weather, beautiful beaches, and vibrant culture. However, living in paradise comes at a cost, and Florida home insurance is one of the significant expenses for homeowners in Miami. The high home insurance costs in Miami have been a cause of concern for residents, with rates consistently increasing over the years. This article will explore the factors contributing to these high insurance costs and delve into the critical drivers behind soaring home insurance rates in Miami, FL. Finding homeowners insurance in Miami can be quite a task. There are many options available, so it can be […]

Florida is no stranger to the devastating impact of natural disasters, making home insurance an essential investment for residents. With frequent hurricanes, floods, and storms, the Sunshine State requires homeowners to secure comprehensive coverage to protect their properties. As we enter 2023, exploring the top-rated home insurance companies in Florida that offer reliable insurance coverage, exceptional customer service, and competitive rates is crucial. This article will provide an overview of the leading providers in the state, helping homeowners make informed decisions when receiving Florida homeowners insurance quotes online. 39 Top rated Homeowners Insurance Companies in Florida In 2023 In addition […]

Miami Home Insurance Rates Drop After 20 Years!

Bathing in Sunshine, Saving with Ease! Discover Jacsonville’s Affordable Homeowners Insurance at FloridaInsuranceQuotes.net!

If homeowners are looking for home insurance, Florida rates can seem astronomical. Florida is the most expensive state in America for home insurance, and there is little relief in sight. The typical premium for the average house in Florida is close to $2000 per year. That is more than four times the cost of insuring a home in America’s least expensive state. As a result, Florida homeowners insurance is more than double the national average. Furthermore, continued cost increases could threaten the state’s reputation for a low cost of living compared to the rest of the nation. Hurricane Claims Are Down. […]

Florida homeowners are frantically trying to shop for a new insurance policy after companies have dropped over 87,000 Florida policies. This sudden policy drop is due to expensive hurricane damage throughout the state. Did they know hurricanes Irma and Michael caused over $15 billion in claims alone? Years later, this is still having an effect. It has people asking why, in 2023, their Florida home insurance company dropped them. Why Did Your Florida Home Insurance Company Drop You? Along with hurricane damages, roofing damage claims are skyrocketing. The spike in claims has caused Florida home insurance costs to rise, leading major carriers […]

Unlock Exclusive Home Insurance Deals: Discover the Best in New Gainesville, Florida

Get instant homeowners insurance quotes online from FloridaInsuranceQuotes.net – exclusively for Hollywood residents.

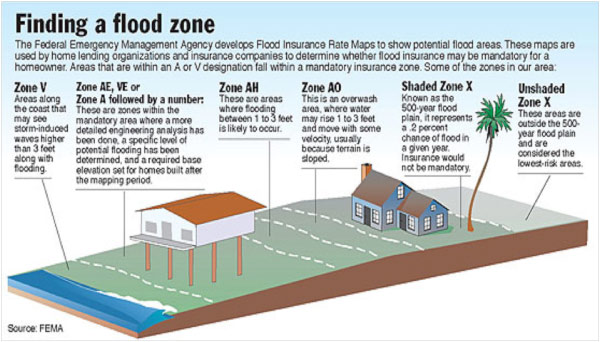

Florida homeowners may soon gain more options for flood insurance. These choices are in addition to what the current federally subsidized national program offers. This offering is due to a measure designed to help encourage more private companies to enter the market. Earlier this month, the Florida Senate passed the bill to provide residents with Florida flood insurance alternatives. While many residents do need some flood insurance in Florida, the lack of options on the market makes it difficult for Florida residents. Most residents have to get it through the federally subsidized program. That program was the only way to get a hurricane […]

Understanding the Bigger-Waters Flood Insurance Reform Act: A Comprehensive Overview

Pembroke Pines Home Insurance Quotes: Comprehensive Coverage for Your Peace of Mind Securing your home’s future with comprehensive insurance coverage in Pembroke Pines. Get a quote now!

Unlocking Vital Insights: Acquiring Fort Lauderdale Homeowners Insurance Quotes

Cost-Effective Home Insurance Solutions in Florida: Find Your Best Deal.

Does anyone know that Florida home insurance rates are actually on the rise? There has been an increase in lawsuits and the prospect of protecting homes in an increasingly depreciating market. Moreover, a home’s location can affect its insurance rates. As a result, homeowners who experience challenging weather in their location may be subject to higher home insurance rates. Persistent Lawsuits Drive Florida Home Insurance Rates Upward Florida, known for its beautiful beaches and stunning sunshine, has also gained a reputation for its high home insurance rates. Homeowners in the state have been grappling with skyrocketing premiums for years, causing […]

South Florida Homeowners Insurance: A Bright Outlook As South Florida residents bask in the sunshine, there’s even more reason to celebrate. Recent developments in the homeowners’ insurance sector are bringing promising changes and exciting opportunities for homeowners across the region. With a combination of state initiatives and market trends, the future of homeowners insurance in South Florida is looking brighter than ever. This article explores the positive changes and offers guidance on how homeowners can benefit from them. Exciting News for South Florida Residents There’s a wave of optimism sweeping through South Florida, and it’s not just about the weather. […]

Mobile homes are a popular housing option in Florida due to their affordability and flexibility. However, mobile homes are susceptible to risks and damages like any other property. That’s why mobile homeowners in Florida must have reliable insurance coverage to protect their investments. This article will discuss the ideal way to obtain accurate mobile home insurance quotes in Florida. Moreover, we cover how Florida Insurance Quotes will help you find the right coverage. Insuring a Florida Mobile Home is Different Lots of people own mobile homes in Florida. Nevertheless, people are still determining whether they can purchase mobile home insurance in Florida. […]