Get Premium Sports Car Insurance Quotes in Florida

High-End Sports Car Insurance here at Florida Insurance Quotes

Get Premium Sports Car Insurance Quotes in Florida

Miami Home Insurance Rates Drop After 20 Years!

As we settle into the new year, many news resources recount actions throughout several industries in 2023. While some sectors experienced slowing growth, others surprisingly finished the year with better sales than expected. For example, the car industry finished surprisingly at the end of 2023, with many automotive industry sources citing better-than-expected results. So, how did the auto industry in 2023 get the job done? This brief article will look at the industry’s activity throughout 2023. The Auto Industry In 2023 Had More Robust Sales Than Anticipated. The most surprising thing about the car industry at the end of […]

Bathing in Sunshine, Saving with Ease! Discover Jacsonville’s Affordable Homeowners Insurance at FloridaInsuranceQuotes.net!

Mr. J. Basile recruited people to engage in staged car accidents. Then, he meticulously organized the accidents while not driving for Metro Chiropractic & Health Center. At the same time, Sergei Kusyakov paid Florida Hospital employees to steal individual data. Then, Kusyakov used the data to solicit legitimate vehicle accident victims for business. This scam is a small example of how insurance fraud affects Florida insurance rates. How Much Does Insurance Fraud Affect Florida Insurance Rates? Specialists say the instances are small samples of fraud that cost Americans millions yearly. This would be a great storyline if we were to […]

If homeowners are looking for home insurance, Florida rates can seem astronomical. Florida is the most expensive state in America for home insurance, and there is little relief in sight. The typical premium for the average house in Florida is close to $2000 per year. That is more than four times the cost of insuring a home in America’s least expensive state. As a result, Florida homeowners insurance is more than double the national average. Furthermore, continued cost increases could threaten the state’s reputation for a low cost of living compared to the rest of the nation. Hurricane Claims Are Down. […]

Those trying to find the best Florida insurance for your needs can see the process as a headache and hassle. There will be many different services and agents promising the best. However, some will be much better than others, as we all know. Florida Insurance Quotes put this quick guide together to help find precisely that. First, pay attention to the three specific steps below. Then, you should get the proper top-of-the-line protection you want. Outline Precisely The Coverage The first step in finding the best insurance in Florida is to outline and understand precisely the type of coverage you […]

Choosing the Best Florida Insurance Company: A Comprehensive Guide

Everyone in Florida needs some form of insurance. Generally, individuals need several kinds. However, selecting from all the Florida insurance companies may be more challenging than deciding which forms of insurance you need. Shoppers have many options. Fortunately, the following tips will go a long way toward helping you make an intelligent decision. Look For A Single Carrier Getting insurance through one carrier through Florida Insurance Quotes is always wise. Of course, there are always exceptions, but the benefits are tough to beat. You would have one number to call and a single agent to deal with. That will be […]

Discover Affordable Florida Insurance Online at FloridaInsuranceQuotes.net Looking for affordable insurance in Florida? Look no further than FloridaInsuranceQuotes.net. With our easy-to-use online platform, you can browse and compare insurance quotes from top providers in the state. Whether you need auto, home, or health insurance, we have you covered. Save time and money by getting a personalized quote online today.

Unlock Exclusive Home Insurance Deals: Discover the Best in New Gainesville, Florida

Get instant homeowners insurance quotes online from FloridaInsuranceQuotes.net – exclusively for Hollywood residents.

Get Instant Car Insurance Quotes Online for St. Petersburg, FL Residents: FloridaInsuranceQuotes.net

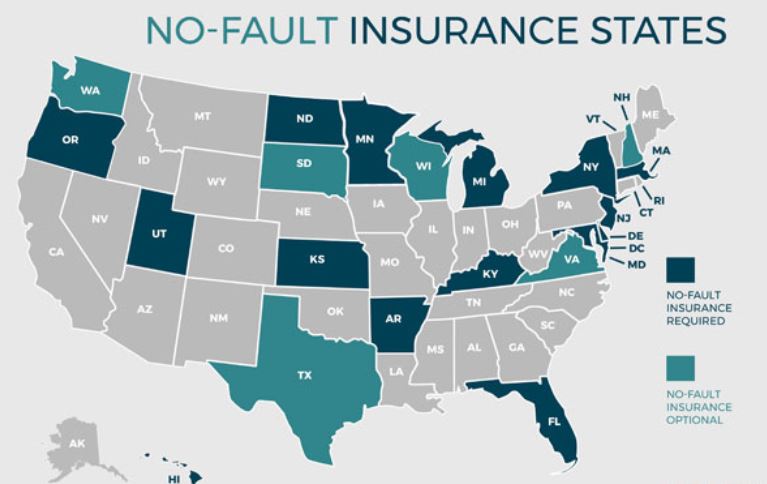

Florida’s auto insurance industry is known for its unique features and benefits that set it apart from other states. With various coverage options and affordable rates, Florida’s auto insurance offers drivers the peace of mind they need on the road. This article will examine how automobile insurance in Florida is different and what makes it an attractive choice for motorists. Florida’s Auto Insurance: Unique Features and Benefits Personal Injury Protection (PIP) Coverage One of the distinctive features of Florida’s auto insurance is the Personal Injury Protection (PIP) coverage. This coverage is mandatory for all drivers in the Sunshine State. It […]

Understanding Florida Tenants’ Rights and Insurance Renting a property in Florida? It’s crucial to know your tenants’ rights and insurance conditions. Stay informed to protect yourself.

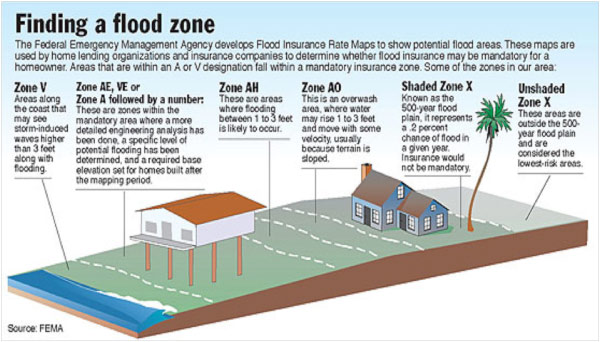

Florida homeowners may soon gain more options for flood insurance. These choices are in addition to what the current federally subsidized national program offers. This offering is due to a measure designed to help encourage more private companies to enter the market. Earlier this month, the Florida Senate passed the bill to provide residents with Florida flood insurance alternatives. While many residents do need some flood insurance in Florida, the lack of options on the market makes it difficult for Florida residents. Most residents have to get it through the federally subsidized program. That program was the only way to get a hurricane […]

Understanding the Bigger-Waters Flood Insurance Reform Act: A Comprehensive Overview

The process can often be time-consuming and complicated when getting car insurance in Florida. However, with the help of Florida Insurance Quotes, this process is now quick and effortless. With our user-friendly website and efficient online tools, you can obtain accurate and instant car insurance quotes in just a few simple steps. In this article, we will explore how Florida Insurance Quotes simplifies the process of getting car insurance quotes online and why we are the go-to resource for all your insurance needs in Florida. Simplify the Process of Getting Florida Car Insurance Quotes Online Getting car insurance quotes in Florida can […]

Insurance has been around for centuries. The Chinese started practicing it to protect their wares from risks as they traveled and distributed them along treacherous waterways. Soon, it became a practice to cover the lives of people. Today, we have insurance for just about anything. Florida Insurance Quotes can write an insurance policy for anything. However, these are some weird Florida insurance policies we have seen. Spooky Weird Florida Insurance Policies When haunted houses became famous, weird Florida insurance policies became the norm. In response, companies created insurance to protect owners from claims due to fear. The first example happened […]

Pembroke Pines Home Insurance Quotes: Comprehensive Coverage for Your Peace of Mind Securing your home’s future with comprehensive insurance coverage in Pembroke Pines. Get a quote now!