Why Medical Payments Coverage Matters in Florida

Should You Add Medical Payments to Florida Car Insurance?

Why Medical Payments Coverage Matters in Florida

Find Florida’s Best Car Insurance Deals Now!

.Navigating the roadways of Florida feels like embarking on a quest. The type of adventure where the destination is unknown, and the driver is just as perplexed as the passenger. In the world of ridesharing, drivers amplify this feeling as they grapple with the complexities of insurance coverage. The Sunshine State’s rideshare insurance situation mixes necessity and confusion with hearty chaos from Miami to Tampa and everywhere. Buckle up as we dive into Florida’s murky waters of rideshare insurance. Moreover, according to Florida Insurance Quotes, we will determine whether drivers are cruising comfortably or just playing a game of chance. […]

As we settle into the new year, many news resources recount actions throughout several industries in 2023. While some sectors experienced slowing growth, others surprisingly finished the year with better sales than expected. For example, the car industry finished surprisingly at the end of 2023, with many automotive industry sources citing better-than-expected results. So, how did the auto industry in 2023 get the job done? This brief article will look at the industry’s activity throughout 2023. The Auto Industry In 2023 Had More Robust Sales Than Anticipated. The most surprising thing about the car industry at the end of […]

Get Instant Car Insurance Quotes Online for St. Petersburg, FL Residents: FloridaInsuranceQuotes.net

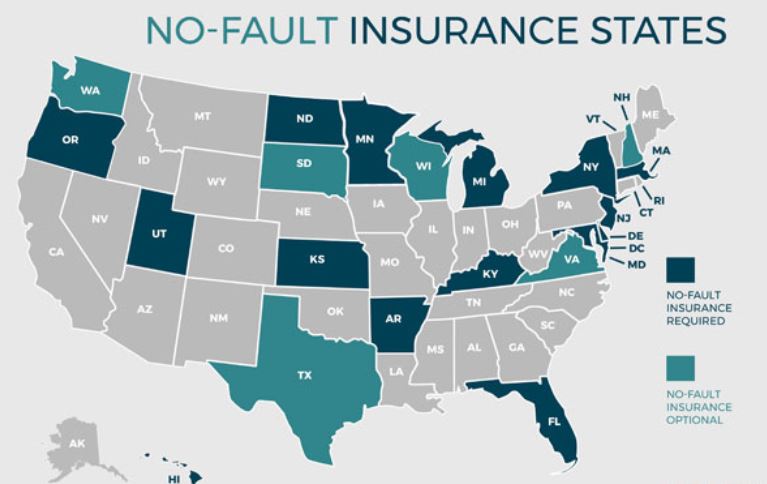

Florida’s auto insurance industry is known for its unique features and benefits that set it apart from other states. With various coverage options and affordable rates, Florida’s auto insurance offers drivers the peace of mind they need on the road. This article will examine how automobile insurance in Florida is different and what makes it an attractive choice for motorists. Florida’s Auto Insurance: Unique Features and Benefits Personal Injury Protection (PIP) Coverage One of the distinctive features of Florida’s auto insurance is the Personal Injury Protection (PIP) coverage. This coverage is mandatory for all drivers in the Sunshine State. It […]

The process can often be time-consuming and complicated when getting car insurance in Florida. However, with the help of Florida Insurance Quotes, this process is now quick and effortless. With our user-friendly website and efficient online tools, you can obtain accurate and instant car insurance quotes in just a few simple steps. In this article, we will explore how Florida Insurance Quotes simplifies the process of getting car insurance quotes online and why we are the go-to resource for all your insurance needs in Florida. Simplify the Process of Getting Florida Car Insurance Quotes Online Getting car insurance quotes in Florida can […]

Get the Best Orlando Car Insurance: Protect Your Vehicle with Confidence

In today’s fast-paced world, efficiency is critical in all aspects of life. It is even more important when searching for the ideal car insurance in Tampa, Florida. With so many insurance providers and policies, it can be overwhelming to compare quotes manually. Luckily, Florida Insurance Quotes is here to simplify the process and ensure you efficiently assess Tampa car insurance quotes. With our convenient and user-friendly platform, you can save time and money while finding the perfect insurance coverage. Benefits of Efficiently Assessing Tampa Car Insurance Quotes How Florida Insurance Quotes Ensures Rapid Evaluation of Tampa Car Insurance Quotes We […]

Unlock the Ideal Car Insurance in Miami: Unbeatable Quotes from Every Florida Insurer! Embarking on a quest to find the perfect car insurance can be as daunting as exploring uncharted territories. But fear not, fellow Miamians, for we have discovered a treasure trove of unbeatable insurance quotes that will not only protect your precious vehicle but also put your mind at ease. Picture this: cruising along the picturesque streets of Miami, wind in your hair, the sun kissing your skin. What could possibly ruin this perfect moment? A fender bender? Expensive repairs? Don’t let these worries cast a dark shadow over your driving pleasure. It all begins with finding the insurance policy that fits your unique needs like a tailor-made suit. But why settle for scraps when you can feast on a buffet of options? In the vibrant city of Miami, every Florida insurer has opened their doors, eager to offer you the best rates imaginable. From the big players that have withstood the test of time to the hidden gems waiting to be discovered, our vast array of insurers has something to suit every driver’s taste. Whether you are a seasoned road warrior or a cautious newcomer, there is an ideal policy waiting to be unlocked just for you. But that’s not all. Besides

Rev up your savings: Unbeatable Jacksonville car insurance deals await! Discover unrivaled quotes from top Florida insurers today!

Welcome to the Sunshine State, where the weather is warm, the beaches are pristine, and the palm trees sway gently in the breeze. Florida is famous for its abundant sunshine, but did you know it also has some unexpected auto insurance essentials? Buckle up and get ready to discover the hidden gems that make auto insurance in the Sunshine State a unique experience! Why Drivers Need Florida Auto Insurance Before hitting the road, everyone needs Florida auto insurance. Most, if not all, drivers can only drive with some auto policy covering themselves and their vehicles. We all know that anything […]

Most people who live in Florida own a car. Unlike many states with extensive transportation systems, Florida is one of the few where driving is the best way to get around. Unfortunately, that does not explain why car insurance is so expensive in Florida. Only some people are excited about paying their automobile insurance every month. However, that is just part of the bitter pill we must swallow when we own a vehicle and want to drive it out on the open road. Being a responsible driver requires you to have auto insurance. So why not get the cheapest car […]

Florida’s Personal Injury Protection (PIP) insurance is an essential coverage that every resident should thoroughly understand. PIP insurance covers medical expenses resulting from car accidents, regardless of fault. However, navigating the complexities of PIP insurance in Florida can be overwhelming. This article aims to provide a vital guide and help you maximize your protection by mastering Florida PIP insurance from Florida Insurance Quotes. Suppose someone has relocated to Florida from another state. In that case, there are some things they need to know about PIP insurance in Florida. It is optional to have certain types of coverage in other states, specifically […]

No one likes to think about getting into a car accident. However, it’s an unfortunate reality that can happen to anyone. That’s why it’s essential to be prepared and understand the insurance options available to you. In the state of Florida, one such option is no-fault insurance. Florida is a no-fault state. Therefore, it follows No-Fault laws. However, many people need to be made aware of the ins and outs of the No-Fault law. Consequently, drivers must understand and purchase no-fault insurance in Florida. Understanding how this type of insurance works can ensure you are adequately protected. Then, you can […]

Florida car insurance laws can be complex and confusing to navigate. Drivers must understand the essential laws surrounding car insurance in the Sunshine State to ensure they adequately protect themselves in the event of an accident. With our expert insights and guidance, you can maximize your protection and secure your ride. In this article, we will break down the key aspects of Florida car insurance laws and provide specialist advice to help you make informed decisions about your coverage from Florida Insurance Quotes. Each state in the United States is unique regarding auto insurance laws. Therefore, when purchasing a policy, it […]

When choosing auto insurance in Florida, finding a provider that offers reliable coverage with excellent customer service is essential. In 2023, Florida Insurance Quotes has emerged as the go-to resource for uncovering the best auto insurers in the Sunshine State. With a dedication to helping Florida drivers find the right coverage at the best rates, Florida Insurance Quotes has become a trusted name in the industry. Let’s dive into the top auto insurers in Florida for 2023, as unveiled by Florida Insurance Quotes. Who Offers Auto Insurance in Florida? Everyone should know which companies offer online quotes for auto insurance […]

How do we know if we must purchase a Florida commercial auto insurance policy? Some businesses require us to have a commercial policy. However, we can still get by with just our coverage. For example, our insurance may cover our insurance if we do not drive over 100 miles daily. These jobs may include social workers, party plan independent consultants, and home health care workers. Our policy will not cover our vehicle when we start using it solely for business purposes like: Making deliveries Allowing multiple drivers Transporting for business purposes Other business-related uses That is when we need to […]

Florida requires FR44 insurance when applying to reinstate their driver’s license following a DUI or DWI conviction. FR44 is a document showing financial responsibility and proving that they carry coverage. However, FR44 requires liability coverage limits to exceed Florida’s minimum. In addition, they may see the term “FR44” written in various ways. For example, they will see it as “FR-44,” “FR44,” and “FR 44.” These variations are still the same thing, just written differently. Why Do They Need FR44? The state of Florida requires FR44 insurance. Drivers guilty of a DUI will have their license suspended and have quite […]

Every time we drive a vehicle, we expose ourselves to risks on the road. There are road hazards, weather hazards, and other drivers to avoid. We all do our best to prevent accidents, but there are times when threats damage the vehicle on the road. For example, we can avoid driving in hurricanes with adequate preparation time, but what about sudden storms? The weather is one reason shoppers should get updated Florida auto insurance quotes. What Are The Most Significant Risks In Florida? We will want to ensure our carrier covers the automobile if a flash flood causes damage to […]